Help us help young people

StartMoneySmart

Four kids make a workshop!

Photo by Bobbie Bush

- How to maintain a checking account?

- How do credit cards work?

- What will come out of their paychecks?

- How to stay organized so bills get paid?

Workshop Pricing

Funding may be available through grants received through Fiscal Sponsorship.

| Number | Price per class |

|---|---|

| 4 - 6 | $50 |

| 7 - 11 | $40 |

| 12 - 21 | $35 |

| Over 22 | $30 |

Prices are based on number of students in attendance.

Workshops can include classes in succession or over several days.

What's been going on...

Johnson & Whales University

In early April Sigma Lambda Gamma invited Start Money Smart to speak at the college in Providence, RI on credit cards and managing debt. The idea came about because one of the members attended a workshop when she was a senior in high school. After graduating and going to college, she asked Jameel back to help educate her sorority sisters. There were many in attendance and the event was very well received. Thanks Eridania!

Money Conference for Women

Jameel drove out to Springfield, MA where the Massachusetts State Treasurer, Timothy Cahill was hosting a Money Conference for Women. With hundreds in attendance, this free all-day conference provided financial information and workshops. Jameel was asked to speak to 20+ parents on the topic of Financially Fit Kids. Some comments, "So amusing, and interesting to listen to. Very different approach to money than I've heard [before]."

METCO Youth Leadership Conference

The METCO Directors' Association held their eleventh annual Youth Leadership Conference at Bentley College in Waltham, MA. This is an all-day conference for selected high school students to come together and learn on topics they would not normally discuss in a typical school day. Students had the opportunity to take workshops on a range of topics from dating violence to interviewing basics. Start Money Smart presented a workshop on Financial Literacy that included checking account basics and information on savings. With hundreds of students in attendance, and over 60 kids to teach throughout the day, it was a wonderful experience.

What's coming up...

Haverhill High School becomes Financially Fit

Start Money Smart will be hosting another workshop at Haverhill High School throughout May. The Violence, Intervention, Prevention (VIP) group is sponsoring the series that is open to the entire student body. Students will learn details on checking accounts, credit cards and budgeting.

Individual Development Accounts

Individual Development Accounts (IDAs) are accounts designed for low-income individuals to encourage them to save money for a specific goal, like buying a house, starting a business, or going to school. IDA Sponsors help individuals set up these bank accounts and find donors to match contributions - sometimes as much as 2 to 1! The only catch - the person has to take a financial literacy course. Start Money Smart has been asked to teach financial literacy by a local IDA Sponsor. Hopefully additional sponsors will also contact Start Money Smart and utilize their services. Click here for more information about IDAs and what they offer.

Quick Links...

- Our Website

- Our Programs

- About Us

- Join our mailing list

What is financial literacy?

Go into a bookstore and find the financial literacy section. You'll find books on "how to invest in the stock market" and "how to save for retirement". If you take the time to look carefully you may find one or two books on how to keep a budget. Most of the books will be about how to get rich. "How do you help people with financial problems?" Is the answer really, "Give them more money?"

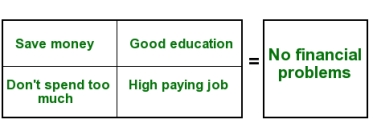

This is the message we believe and teach in our culture:

And most financial education courses tend to focus on this same philosophy - wealth accumulation.

After meeting so many smart, educated people, with money, who didn't seem to have any ideas about how to keep a budget, or pay their bills on time, Start Money Smart was founded. Teaching people how to invest and how to save is important, but there is so much more. Financial literacy has to be more than teaching wealth accumulation.

You have to visualize it!

I admit it - I am not a reader. I'm not one of those people that like to hunker down with a good book and lose myself in a story. Instead you may find me hunkering down over a good puzzle - crosswords or crostics being my current favorites. But reading, not my thing.

Even when I'm handed a nice thick workbook on financial education (my favorite speaking topic), I tend to thumb through the pages with intended interest, only to quickly lose focus as I see all the reading that's expected to take place.

"Then why do you like to write?" a co-worker asked me some years ago. "Well, that's different," I responded, not understanding my reply, even as I said it. I love to communicate - I love to talk, and writing, in my eyes, is an extension of that. But I think it requires a different set of neurons to love to read.

I'm amazed at the number of people who take out the time to read my blog or this newsletter for that fact. And I know a high percentage of people don't. It's the pictures they glance over, and if the picture catches their eye, then they'll stop to read.

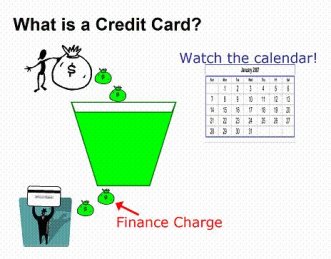

So I approach my workshops with the same philosophy - find a way to visualize it.

Start Money Smart offers workshops for adults, parents, and teenagers that address these and other topics regarding financial literacy. Check out our website for more information.

- It's a bucket of money given to you by a credit card company.

- It's your job to keep that bucket full.

- The calendar is the most important thing when it comes to having a credit card. You have to watch those dates!

- If you take any money out of the bucket, you have to put it all back by the designated date. If you do, no problem.

- If you don't put back ALL the money you took out of that bucket by the specified date, the company will drain money (called finance charge) out of that bucket. It's your job to put that money back too.