Welcome!

Thanks for expressing an interest in understanding, organizing, and managing your personal finances!

What's been going on...

Jameel was nominated to present at the Center for Women & Enterprise's annual State House Day. She had the opportunity to express to her legislators, as well as other clients of CWE, her passion for instilling change within our educational system in the area of personal finance.

What's coming up...

The Faith Christian Church of Dorchester is celebrating their 27th Anniversary from April 26th through the 29th. The theme of the weekend will be "Total Health", in which they will be offering workshops and seminars. They've asked Jameel to speak on Financial Health on Saturday April 28th at 9:30AM.

Stay tuned for Start Money$martTM!

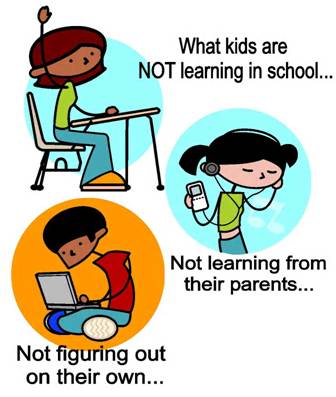

A new division of MJOrganizers is being developed that will focus on educating young people in the areas of Personal Finance.

Seminars will be offered to parents for their children to learn what the schools will never teach them - all about checking accounts, credit cards, paying bills, paychecks, taxes and more...

Stay tuned for more information!

Quick Links...

- Our Website

- About Us

- Join our mailing list

March's Thoughts on Personal Finance

e-Newsletter for Mar '07

Checking Accounts, Credit Cards, Paying Bills, Paychecks, Taxes, Check Writing, Credit Scores, Managing Debt.

How will your kids learn these things?

Have your kids Start Money$martTM!

Call MJOrganizers for seminar information.

The Myths of Personal Finance

Myth #3 - Smart People don't have money problems!

An incredibly incorrect assumption made in our society is that people who have financial problems must be uneducated. However, most of my clients are very well educated and manage much responsibility, but they have problems getting bills paid on time every month.

What do you need to pay your bills? Enough money? Enough brains? Enough time? The truth is - all three! However, having money and brains can't do it alone. So many people I know don't allocate enough time to the task of managing their personal finances. In addition to assuming this is common sense, is the assumption that it's simple and will take a minimal amount of effort.

Many people don't want to spend a lot of time thinking about paying bills, so they put their energy elsewhere. The little consequences can really add up for some people. And intelligence has nothing to do with it.

True Story - A friend of mine was the personal assistant for a successful Investment Advisor. She had told me about how her boss had gone on a one week trip out of the country with his family to invest in a real estate opportunity. While he was gone he received the third notice on a $66 water bill he had been neglecting. His family returned on a Saturday morning to find that their water had been turned off. He called the Water Company who explained that they couldn't turn the water on until Monday morning. So on Monday my friend received instructions to drive the money to the Water Company and pay the delinquent bill. On the way, her boss's wife called her to find out how much longer before the water would get turned on. "This is ridiculous," she complained. "He's buying five million dollar condos, and I can't wash my hair!"

Don't make the assumption that sending your kids to a good college will teach them how to get their bills paid. Schools don't teach these topics and they are not common sense!

Invite Jameel Webb-Davis to come to your school, church, or organization and speak on these and additional topics regarding personal finance.

Next month...

Myth #4 - Men understand money better than women.