Welcome!

Thanks for expressing an interest in maintaining, organizing, and educating yourself, and your family, about your personal finances!

What's been going on...

StartMoneySmart was featured on a local radio show!

Your Financial Compass with John and Rosemarie Boyd is a local, live radio show that airs every Saturday at 11AM on WCRN 830AM. Jameel was asked to speak for an hour regarding financial education and the services Start Money Smart offers. For more information about this program and other services offered by the Boyds, go to www.boydtalk.com.

StartMoneySmart spoke at Rediscovery

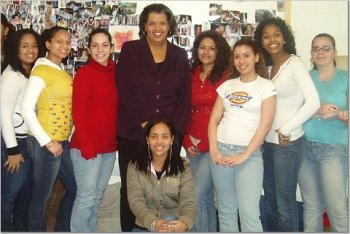

Rediscovery, Inc. asked Jameel Webb-Davis to be a guest instructor for a financial literacy program. Rediscovery, Inc. is a small nonprofit, community based, group home and independent living program that offers services to youth of ages 16-22 who are in the care/custody of one of the Massachusetts state systems of care. Their Financial Literacy program is a series of one to two hour workshops each of which covers a different aspect of personal finance that is pertinent to youth development. Learn more about Rediscovery, Inc. and its programs.

Jameel Webb-Davis is the instructor for CWE's summer Wi$e Up Finance Workshop.

The Center for Women and Enterprise has asked Jameel Webb-Davis to be an instructor for this summer's Wi$e Up Finance Workshop. In June she instructed in Worcester, MA and in July the class was held in Providence, RI. The class features instruction via video conference to the other locations, which also include the Boston, MA location. The combination of workshops, self-study and on-line modules gives teenagers the knowledge and tools so that they can make smart money choices. Learn more about the Wi$e Up Program.

What's coming up...

StartMoneySmart is working to convert to a Non-Profit Organization.

A non-profit organization is driven by its mission, which usually includes improving the condition of an individual, a neighborhood, or the global community. While the success of a For-Profit business is judged by the amount of profit earned, the success of a Non-Profit is judged by how well it fulfills its mission, as well as its financial responsibility.

It has become overwhelmingly clear that fulfilling Start Money Smart's mission must be the priority over making a certain amount of money. Our mission is to provide products and services to help people in all areas related to understanding, organizing and educating themselves about their personal finances.

Becoming a Non-Profit will allow us to offer workshops to any school or organization regardless of budget. It'll increase our advertising scope, as well as make us eligible for local and government grants.

See what's new on the website!

- Support Start Money Smart by making a donation on-line! Click here for more information.

- MJOrganizers has its own separate website focused at helping small business owners and organizations stay financially organized! Check it out!

- Review other organizations with financial literacy information, tools for parents, and articles to review. Check out our new Resources link.

- Our Blog is coming soon - all your seminar questions answered!

Quick Links...

- Our Website

- Our Programs

- About Us

- Join our mailing list

Help us help young people Start Money Smart!

Help us become a Non-Profit Organization so we can offer programs to any school or organization regardless of budget.

"Why isn't personal finance taught in schools?"

This question has been plaguing me since I decided to create Start Money Smart. And many others are asking this same question. There are financial literacy web pages that generate great discussion on the topic (here's one to review). Many people really believe it should be a priority when educating our young people. So why hasn't it happened? Why isn't personal finance added to standard curriculums in American schools systems?

Well, I've done some research, and here's what I've found...

Teens don't need to know personal finance to go to college! Standard curriculums in schools are already filled with what kids are required to learn. Many schools will tell you there is no room for additional topics. Schools are under great pressure to generate students who are considered "educated", which really means "prepared for college". It doesn't mean "prepared for life". If it's not on the MCAS test or an SAT exam, there's not a lot of justification for teaching the topic in today's public school system. And the truth is kids don't need to know personal finance to go to college. However, they're inundated with credit card applications when they arrive, and given no education on how to deal with them.

Our "money" world is changing too fast. If you're old enough think back and remember what money was like thirty years ago. Credit cards and charge cards were only for the rich. A 25% interest rate on a credit card was considered loan-sharking. Did anyone ever hear of automatic deduction? What about twenty years ago? There were ATM cards, but no debit cards and no one did on-line banking. Okay, so ten years ago? Well, there were very few pre-paid debit cards, and kids were not running up their parent's phone bill by texting their friends.

Our money world is changing too fast, and we haven't been able to keep up with educating ourselves on how to handle it. So for those people who still think, it's up to the parents to educate their kids on personal finance - I'll argue that most parents don't know what to teach their children. They haven't learned the rules themselves yet.

We still believe more money will provide the knowledge. I believe our biggest problem with making a change to our educational system is getting over the idea that "If we just make more money, it'll be okay." Some of us are working so hard to educate our youth, and to what end? So they can go to good colleges, and get good jobs, and make good salaries. We still believe that if our kids make enough money, they'll be okay. They'll some how learn how to balance that checking account. They won't buy things they can't afford, because they'll magically know how to create a budget for themselves. They'll figure out taxes and what they need to do to pay their bills on time every month.

If we really want to make a difference in increasing financial literacy in America, we have to let go of the idea that being rich solves problems. In many cases it just creates the need for more education.

Start Money Smart offers workshops for adults, parents, and teenagers that address these and other myths regarding money. Check out our website for more information.